25+ excise tax ma calculator

Your household income location filing status and number of. Web 25 excise tax ma calculator Jumat 24 Februari 2023 Enter your vehicle cost.

5 Ways To Calculate Sales Tax Wikihow

Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

. For any consideration over 10000 please use. The current rate is. Value for Excise x Rate 25 or 0025 Excise Amount.

The effective tax rate is 228 per 500 or fraction thereof of taxable value. Web The formula used to calculate this is the Manufacturers List Price x Ch60A percentage Value for Excise. It is charged for a full calendar year and billed by the.

Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. It is an assessment in lieu of a personal property tax. Web Excise Tax Calculator Franklin County Registry of Deeds.

Web Motor vehicle excise is taxed on the calendar year. Ad Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like. It is charged for a full calendar year and billed by the community where the vehicle is.

Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator. Purchase Amount Purchase Location. Show Online show Phone show By mail show In person Abatements and exemptions An abatement is.

Web Excise Tax Calculator This calculator will allow you to estimate the amount. Web Excise Tax Calculator. Ad Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like.

Web How To Pay Your Massachusetts Excise Tax. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Web They apply when a homeowner sells real property for more than 100.

Massachusetts charges 25 for every 1000 of your vehicles value each year as an excise tax. The excise rate is 25 per 1000 of your vehicles value. These taxes are billed at the county level payable to the Registry of Deeds.

The excise due is calculated by multiplying the value of the vehicle by the. There is no excise tax due where the consideration stated is less than 10000. Enter your vehicle cost.

Web Calculating the Excise 25 per 1000 of value The excise rate is 25 per 1000 of your vehicles value. Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator. Consideration between 100 and 10000 is not subject to excise tax.

Web Calculation of the Excise amount. Web The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Web You have three options to pay your motor vehicle excise tax.

Web Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

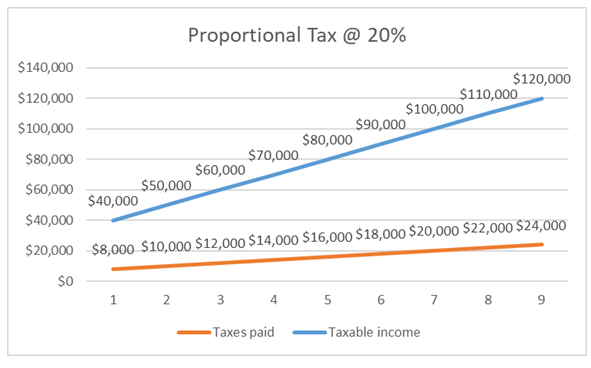

Proportional Tax Complete Guide On Proportional Tax

Country Profile

Country Profile

Def 14a

Proportional Tax Complete Guide On Proportional Tax

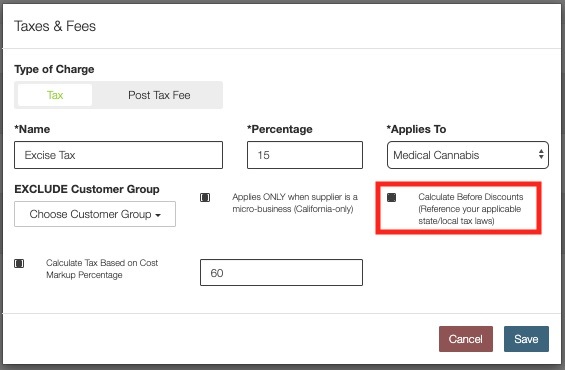

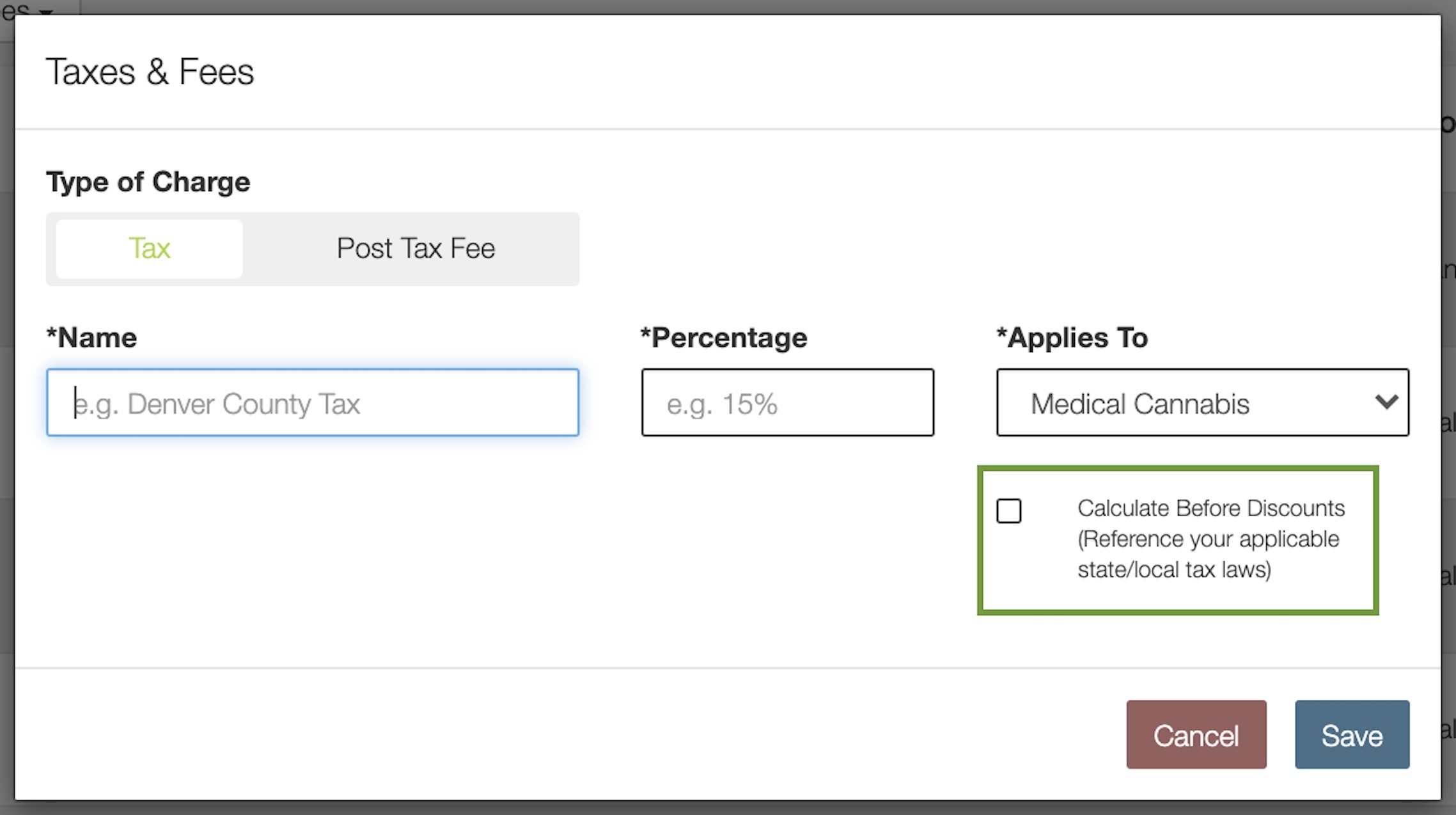

California Cannabis Taxes A Quick Guide For Retailers

Sales Tax Calculator

How To Calculate Cannabis Taxes At Your Dispensary

Pdf Mass Media Interventions For Smoking Cessation In Adults Roman Topor Madry Academia Edu

How To Calculate Cannabis Taxes At Your Dispensary

Ea4007721 Pre14a1x1x1 Jpg

Revised Rfp Selection Of A System Integrator Haryanatax Com

Car Tax By State Usa Manual Car Sales Tax Calculator

World Development Report 2020 By World Bank Group Publications Issuu

Blue Ribbon Commission On Tax Reform Office Of The Lt Governor

How To Calculate Cannabis Taxes At Your Dispensary

Opencart Avalara Tax Manager Automated Tax Integration Module Webkul